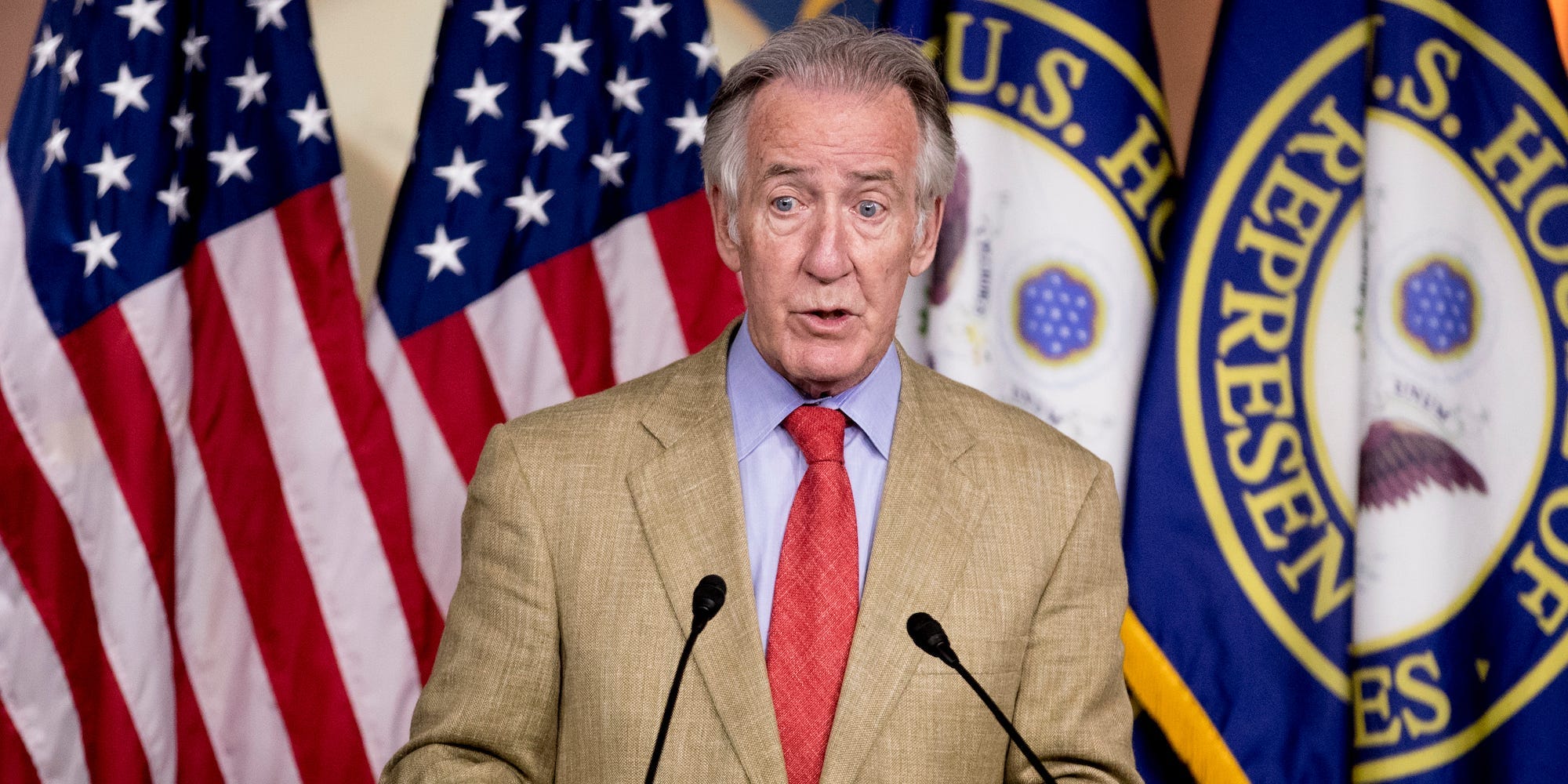

AP Photo/Andrew Harnik

- The House Ways and Means Committee unveiled a stimulus measure to extend unemployment benefits through August 29.

- This contrasts President Joe Biden’s request to extend the benefits through the end of September.

- Other measures in the bill include $1,400 stimulus checks at the $75,000 income threshold and a $3,000 child tax credit.

- Visit the Business section of Insider for more stories.

The House Ways and Means Committee unveiled a draft bill of stimulus measures on Monday, which included extending $400 monthly unemployment benefits through the end of August and issuing $1,400 stimulus checks without changing the income threshold.

House committees are in the process of marking-up stimulus legislation before the pandemic reconciliation package is likely to head to a full House vote at the end of February. The House Ways and Means Committee, led by Chairman Richard Neal, released the language of its budget measures on Monday and revealed its proposal to extend $400 monthly unemployment benefits through August 29. This differs from President Joe Biden’s request for benefits to be extended through the end of September to ensure unemployed Americans continue to receive the aid that they need.

“From increasing direct assistance to those who need it most to expanding tax credits for low- and middle-income workers, we deliver substantial solutions in this package,” Neal said in a statement. “While it is still our hope that Republicans will join us in doing right by the American people, the urgency of the moment demands that we act without further delay.”

Sen. Ron Wyden of Oregon said in a statement on Monday that he will push to preserve six months of unemployment benefits, and that both stimulus checks and unemployment benefits played a “critical role” in supporting families.

“We can do both,” Wyden said.

In addition to the unemployment benefits included in the draft bill, other key proposed measures include:

- $1,400 stimulus checks at the previous $75,000 income threshold;

- Expanding a fully refundable, $3000 child tax credit per child;

- Increasing the Affordable Care Act's premium tax credits to reduce healthcare premiums for low- and middle-income families;

- Stabilizing pensions for more than one million Americans;

- And increasing public health and social services.

The House Education and Labor Committee on Monday released its draft bill, as well, which included the $15 federal minimum wage increase and $130 billion for reopening K-12 schools.